Contact Information:

Published Content

Hotel Acquisition Gone Wrong: Learn to Spot Hidden Pitfalls & Generate ROI

Discover the changed hotel investment market! Discover key points not displayed in statements. How this one lesson saved a career.

The $2.8 Million Hotel Deal That Nearly Bankrupted Me (And the Lesson That Saved My Career)

Five years ago, I was thirty minutes away from closing on what looked like the perfect hotel acquisition. The property was a 48-room boutique hotel in downtown Portland that had been struggling under absentee ownership for three years. The seller was motivated, the price was $2.8 million (40% below peak market value), and the financial projections showed I could increase revenue by 60% within eighteen months through basic operational improvements.

Every metric supported the acquisition. Occupancy rates had declined to 52% due to poor management, but comparable properties in the area averaged 78%. The average daily rate was $89, while competitors charged $125-140. Food and beverage revenue was virtually nonexistent despite the hotel having a street-level restaurant space that had been closed for two years. On paper, this was exactly the kind of distressed hospitality asset that generates exceptional returns for knowledgeable operators.

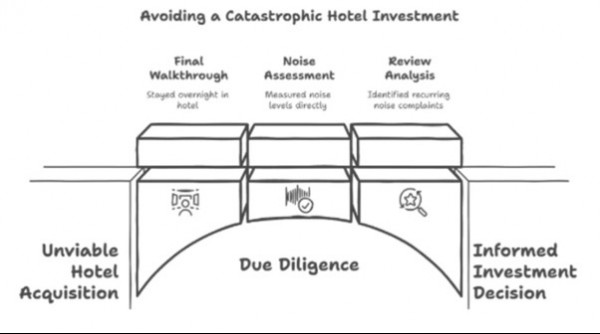

But twenty-four hours before closing, something made me pause. During my final walkthrough, I noticed that guest reviews consistently mentioned one specific complaint: noise from the street below. I'd dismissed this as minor during previous visits, but that night I decided to stay in a room myself. What I discovered almost cost me $2.8 million.

Want to learn more about hotels as a commercial property? Visit https://realmo.com/hotels/for-sale/

Why Today's Hotel Acquisition Market Is Unlike Anything We've Seen

The hotel acquisition landscape has fundamentally changed in ways that make traditional investment approaches not just insufficient, but dangerous. Understanding these changes is essential for anyone considering hospitality investments in today's market.

The demand patterns that drove hotel profitability for decades have been permanently altered. Business travel, which historically provided consistent weekday demand at premium rates, has decreased by 40-50% as companies embrace remote work and virtual meetings. This shift eliminates the predictable revenue base that many hotel pro formas relied upon, particularly for urban properties that catered to corporate travelers.

Leisure travel has increased but with different characteristics that affect profitability. Today's leisure travelers book closer to arrival dates, are more price-sensitive, and have higher service expectations influenced by vacation rental experiences. They expect hotel amenities while demanding Airbnb-level personalization and local authenticity. Meeting these expectations requires operational capabilities that many traditional hotels don't possess.

Revenue Analysis: Understanding What Really Drives Hotel Profitability

Successful hotel acquisition requires understanding revenue generation patterns that have changed dramatically since traditional hospitality investment models were developed. The old approach of multiplying rooms by average daily rate by occupancy percentage completely misses the complexity of modern hotel revenue generation.

Revenue Per Available Room (RevPAR) Evolution

RevPAR remains the fundamental hotel performance metric, but understanding what drives RevPAR changes has become more complex. Traditional RevPAR calculation assumes consistent pricing power and occupancy patterns that no longer exist in many markets. Weekend rates might be 200% higher than weekday rates, while shoulder season pricing can vary dramatically based on local events, weather, and competitive dynamics.

I recently analyzed a 65-room hotel in Charleston where weekend RevPAR averaged $285 while weekday RevPAR was only $95. The owner was marketing this as an $8.2 million opportunity based on peak performance, but the reality was that sustainable annual RevPAR was closer to $145. Understanding these patterns prevented my client from overpaying by $1.8 million.

Dynamic pricing has become essential for revenue optimization but requires sophisticated systems and constant management. Properties using revenue management software can achieve 15-25% higher RevPAR than those with static pricing, but implementation requires training and ongoing operational changes that many owners underestimate.

Ancillary Revenue Streams and Their Real Impact

Food and beverage operations can either significantly enhance or severely damage hotel profitability, and distinguishing between the two requires careful analysis of space utilization, labor requirements, and market positioning. A hotel restaurant that generates $800,000 in annual revenue might contribute $200,000 to hotel profits or lose $150,000, depending on operational efficiency and market positioning.

Parking revenue in urban locations has become increasingly valuable as cities restrict parking supply. Hotels with dedicated parking can charge $25-45 per night in major markets, potentially adding $150,000-300,000 annually for a 100-room property. However, converting parking space to other uses might generate even higher returns through additional rooms or event space.

Meeting and event space utilization directly impacts profitability through both direct revenue and room night generation. A hotel that books a 50-person corporate meeting generates direct meeting room revenue plus 25-40 room nights plus food and beverage sales. Properties with flexible event space can achieve 20-30% higher total revenue per square foot than those focused solely on accommodation..

Operational Due Diligence: What Financial Statements Don't Tell You

Hotel operational analysis requires understanding systems, processes, and organizational capabilities that directly impact financial performance but aren't reflected in historical statements.

Staff Structure and Service Quality Assessment

Labor productivity in hotels varies dramatically based on property layout, systems efficiency, and management quality. A well-organized 80-room hotel might operate efficiently with 25 full-time equivalent employees, while a poorly managed property of similar size might require 40+ employees to provide comparable service levels.

Guest service quality directly impacts revenue through repeat business, online reviews, and rate premiums, but measuring service quality requires observation and analysis beyond financial metrics. Properties with consistently high guest satisfaction scores can charge 10-20% rate premiums while achieving higher occupancy than comparable properties with poor service reputations.

Management depth and succession planning affect operational stability and growth potential. Hotels dependent on single key managers face significant risk if those individuals leave, while properties with documented systems and cross-trained staff can maintain consistency through personnel changes.

Technology Infrastructure and Integration

Property management system capabilities determine operational efficiency and guest experience quality. Modern systems integrate reservations, check-in, housekeeping, maintenance, and accounting functions while providing real-time reporting and revenue management tools. Properties with outdated systems require manual processes that increase labor costs and error rates while limiting revenue optimization capabilities.

Online reputation management has become essential for hotel success as 85% of travelers check online reviews before booking. Properties with poor online ratings struggle to achieve market-rate pricing regardless of physical condition or service quality. Monitoring and responding to online reviews requires dedicated attention and systematic processes.

Brand Affiliation vs. Independent Operations: The Critical Decision

The choice between branded and independent hotel operation significantly affects acquisition strategy, operating requirements, and long-term value creation potential.

Franchise Brand Analysis and Value

Major hotel brands provide reservation system access, marketing support, and operational standards that can increase occupancy and rates for well-positioned properties. Brand recognition drives direct bookings and customer loyalty, particularly important for business travelers and families seeking consistent experiences.

However, franchise fees typically cost 8-12% of gross revenue, significantly impacting profitability. Management fees, marketing fees, reservation system fees, and required property improvements can total $300,000-500,000 annually for a 100-room property. These costs must be justified through higher revenues and operational efficiencies.

Brand standards requirements often mandate expensive property improvements, furnishing replacements, and ongoing compliance costs that independent properties can avoid. Some brands require property renovations every 7-10 years costing $15,000-25,000 per room, significantly affecting long-term capital requirements.

Independent Hotel Positioning and Marketing

Independent hotels can develop unique positioning and marketing strategies that differentiate them from standardized brand properties. Local character, personalized service, and authentic experiences often command premium pricing from travelers seeking alternatives to generic hotel experiences.

Marketing independent hotels requires more sophisticated strategies than branded properties because they lack built-in reservation systems and brand recognition. Successful independent operators invest heavily in online marketing, direct booking optimization, and local partnership development to drive awareness and reservations.

Operational flexibility allows independent hotels to adapt quickly to market changes and guest preferences without corporate approval processes. This agility can be particularly valuable during market disruptions or when pursuing unique revenue opportunities.

Financial Modeling and Valuation: Getting the Numbers Right

Hotel valuation requires sophisticated financial modeling that accounts for cyclical demand patterns, operational leverage, and market-specific factors that don't apply to other commercial real estate investments.

Cash Flow Projection and Sensitivity Analysis

Hotel cash flows are highly sensitive to occupancy and rate changes, requiring stress testing under various market scenarios. A 10% decrease in occupancy combined with 5% rate pressure can reduce cash flow by 25-35% due to high fixed costs and operational leverage.

Seasonal cash flow variations must be modeled accurately because many hotels generate 40-60% of annual cash flow during peak seasons. Properties in seasonal markets require larger cash reserves and different financing structures than year-round operations.

Valuation Method Selection and Application

Income capitalization approaches work best for stabilized hotels with consistent operating histories, but market conditions and operational changes can make historical performance irrelevant for future projections. Using inappropriate capitalization rates or growth assumptions can result in valuation errors of 20-40%.

Comparable sales analysis requires understanding transaction details that aren't always publicly available. Sales prices alone don't indicate value because terms, conditions, and property-specific factors significantly affect transaction structure and pricing.

Discounted cash flow analysis provides the most flexibility for modeling operational improvements and market changes, but requires accurate assumptions about revenue growth, expense management, and terminal values that can be difficult to predict in volatile markets.

Due Diligence: Avoiding the Hidden Pitfalls

Hotel due diligence requires investigating operational, financial, and market factors that can significantly impact investment success but aren't apparent from standard property inspections or financial reviews.

Market and Competitive Analysis

Local market demand generators change over time, affecting hotel performance in ways that historical data doesn't predict. Major employers relocating, convention centers closing, or transportation pattern changes can dramatically alter hotel demand without warning.

Competitive supply analysis must consider not just existing hotels but also planned developments, vacation rental penetration, and alternative accommodation options that serve similar market segments. New hotel developments can oversupply markets for years, while Airbnb concentration can pressure rates in certain neighborhoods.

Legal and Regulatory Considerations

Zoning compliance and use permits can restrict hotel operations or require expensive modifications. Some municipalities limit hotel development or impose special taxes and fees that affect profitability. Understanding local regulations prevents costly surprises after acquisition.

Environmental compliance requirements vary by location and property age. Older hotels might have asbestos, lead paint, or underground storage tank issues that require remediation. Environmental problems can delay openings and require substantial unbudgeted expenses.

Financial and Operational Verification

Revenue verification requires analyzing booking patterns, rate structures, and source mix to ensure reported performance is sustainable and accurately represented. Some sellers manipulate occupancy or rate data during marketing periods to inflate performance metrics.

Expense analysis should identify which costs are truly necessary versus which result from poor management or vendor relationships. Many hotels have expense structures that can be improved through better procurement, energy efficiency, or operational optimization.

Making Hotel Investment Work in Today's Market

The Portland hotel deal that I walked away from taught me that successful hotel investment requires understanding not just financial projections, but the fundamental factors that drive guest satisfaction and operational success.

The most successful hotel investments today share several characteristics: they focus on markets with diverse demand generators rather than depending on single sources, they invest in operational capabilities and guest experience rather than just physical improvements, they understand their competitive positioning and differentiation opportunities, they plan for higher labor costs and different staffing models than historical norms, and they maintain flexibility to adapt to changing market conditions and guest expectations.

The hotel industry offers substantial opportunities for investors who understand its complexities and commit to active management or partnership with experienced operators. Properties that provide authentic experiences while meeting modern service expectations can achieve exceptional returns in markets where traditional business models struggle.

Published Content

See all listings from Published Content

Newsletter

To sign up up for www.glos.info weekly newsletter, please click here.

Please mention www.glos.info when contacting this advertiser.